Have you ever heard your grandparents reminisce about the “good old days,” when a loaf of bread was just a few cents and a full meal out cost less than a dollar?

It’s no surprise that prices have soared over the decades, but the comparison between then and now is truly staggering.

While inflation is the main reason for this shift, it’s fascinating to take a closer look at how drastically prices have changed in just the last century. From groceries and gas to homes and concert tickets, everything costs significantly more today than it did decades ago.

Let’s travel back in time to explore how the prices of everyday items and essentials have transformed over the years.

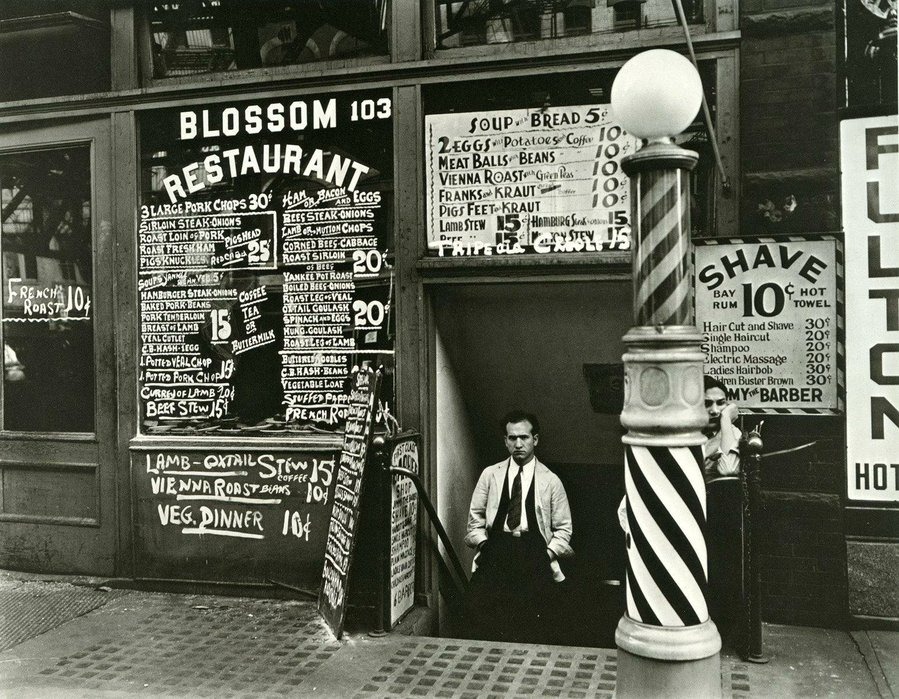

The Price of Dining Out: A Different Experience

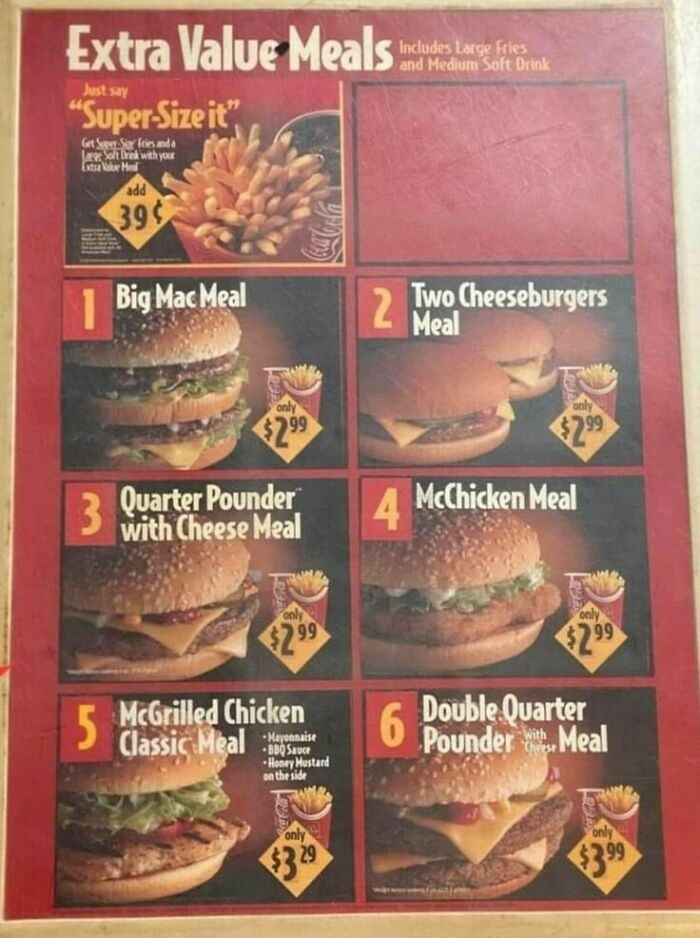

An old McDonald’s menu

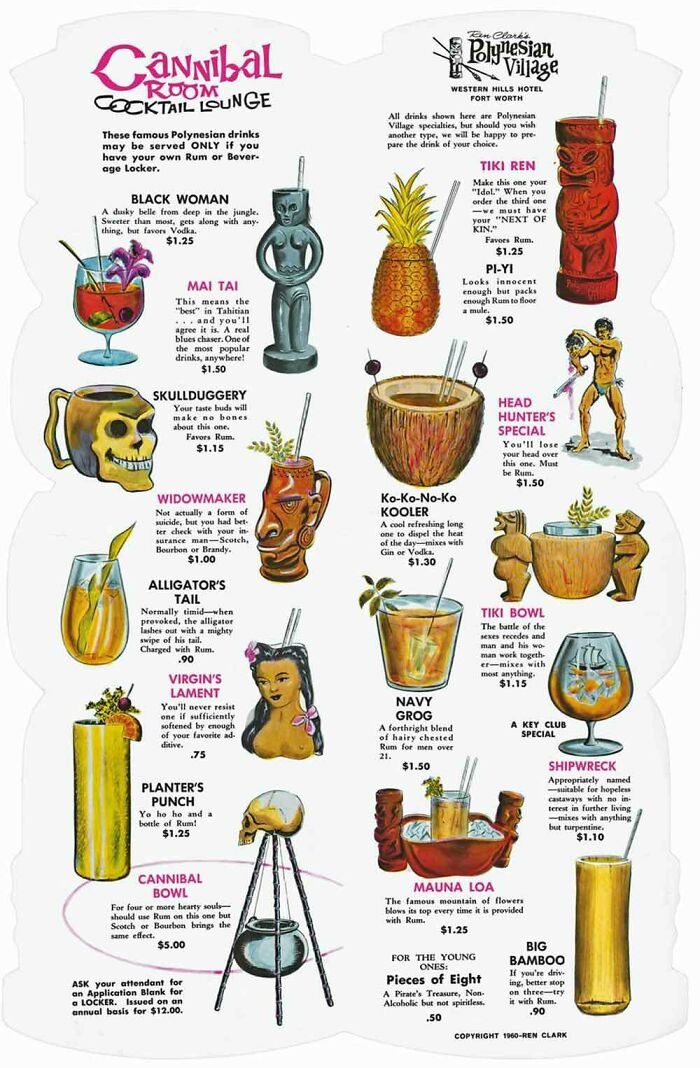

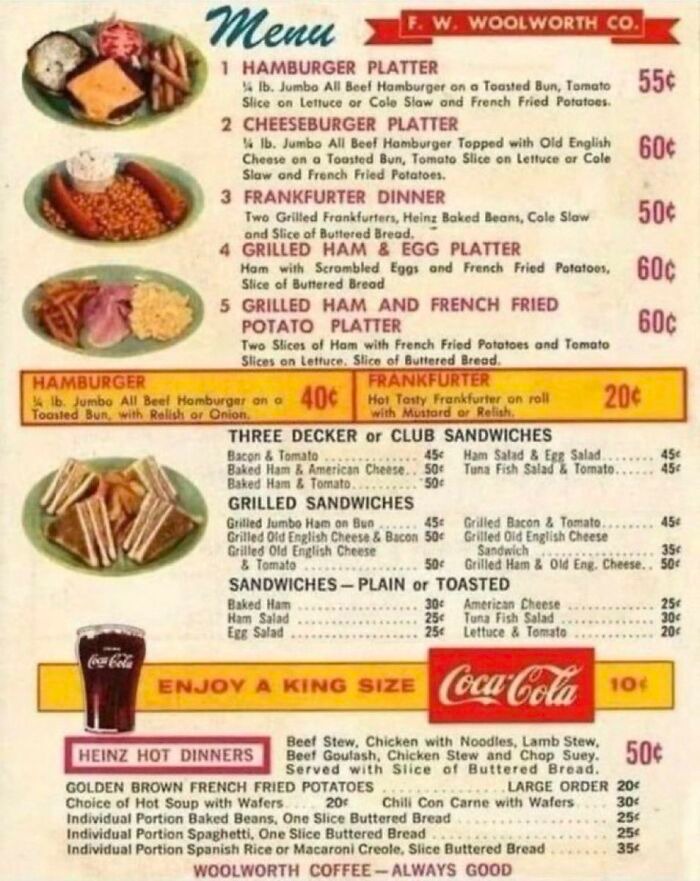

If you look at an old menu from a diner or McDonald’s, you’ll be shocked by the prices. Imagine paying less than $1 for a full meal!

For instance, in the 1960s, McDonald’s meals were less than $4—unthinkable in today’s world of $15 fast food combos. A diner menu from the same era showed that nothing cost more than a dollar.

The average cost for a cup of coffee was just a nickel, and a full breakfast plate with eggs, toast, and bacon could be had for around 50 cents.

Then: A sandwich for 30 cents.

Now: A sandwich for $10 or more, depending on where you eat.

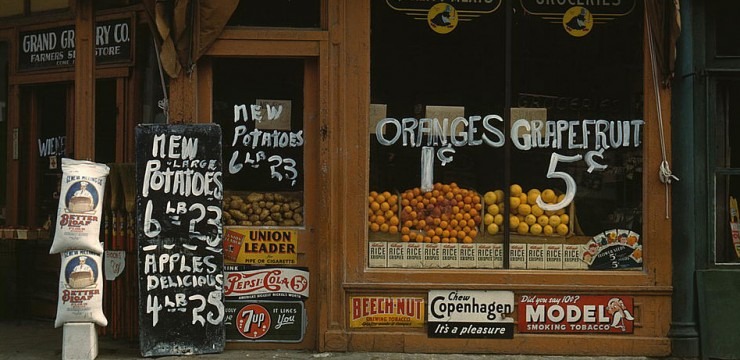

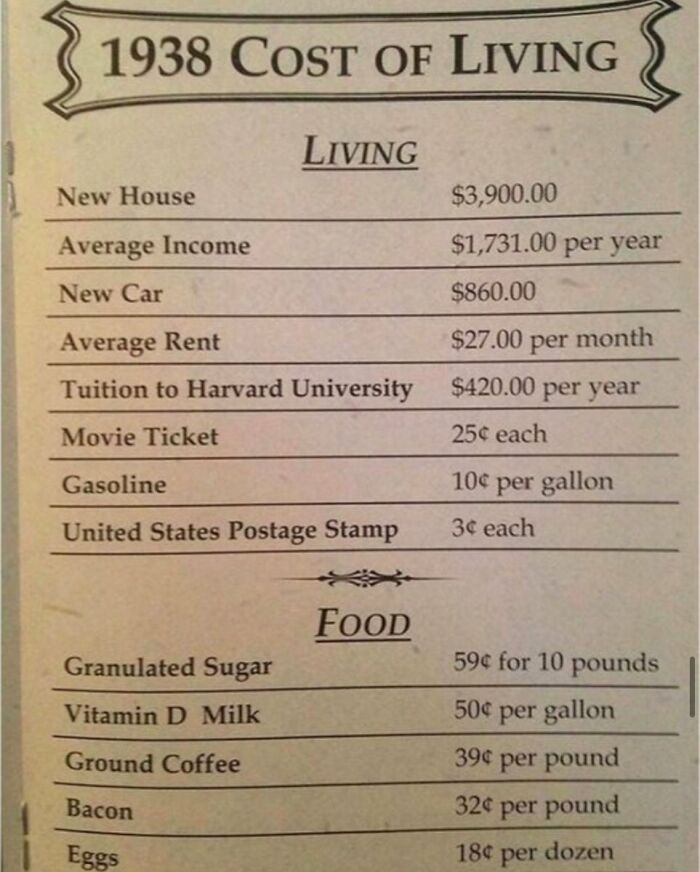

Grocery Shopping: From Pennies to Dollars

One of the most telling indicators of inflation is the cost of groceries. A century ago, you could walk into a market and buy fresh fruit for mere pennies.

Ads from the 1930s showed oranges for 1 cent each and grapefruits for just 5 cents. A dozen eggs could be purchased for around 19 cents, and meat prices were so low that a family could easily afford a week’s worth of groceries on a small budget.

Compare this to today’s grocery prices, and it’s clear that the cost of living has skyrocketed. The affordability of groceries in the past allowed for a single income to support a family—something far less common in today’s world.

Then: Fresh eggs for 19 cents a dozen.

Now: Eggs can cost $4 or more depending on the market.

The Cost of Housing: Homes for a Fraction of Today’s Prices

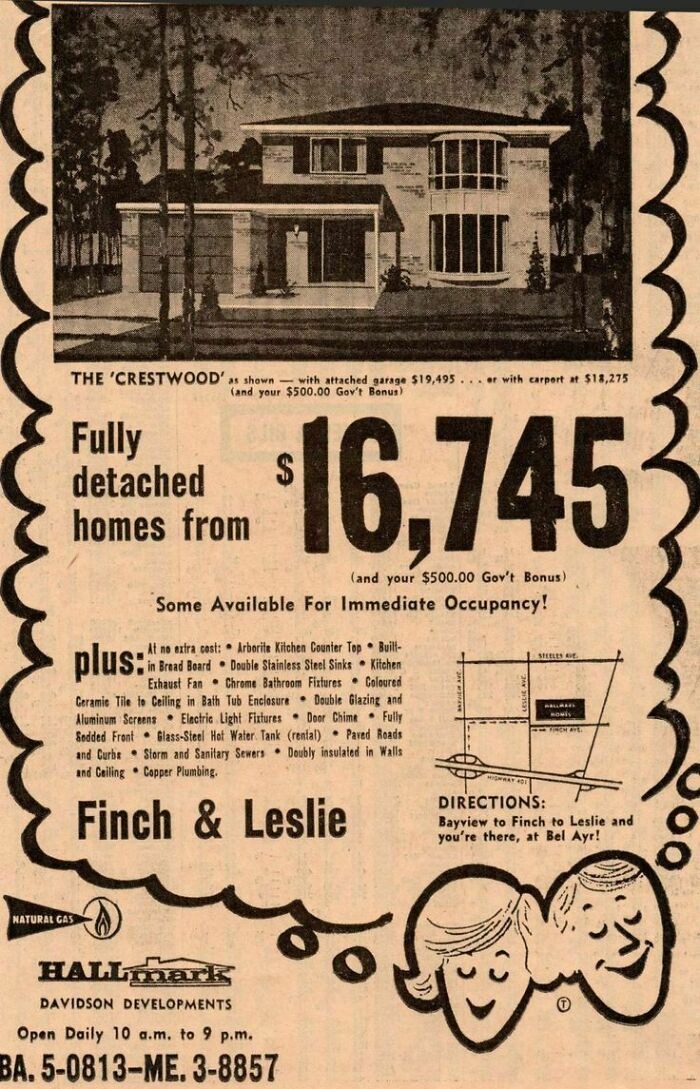

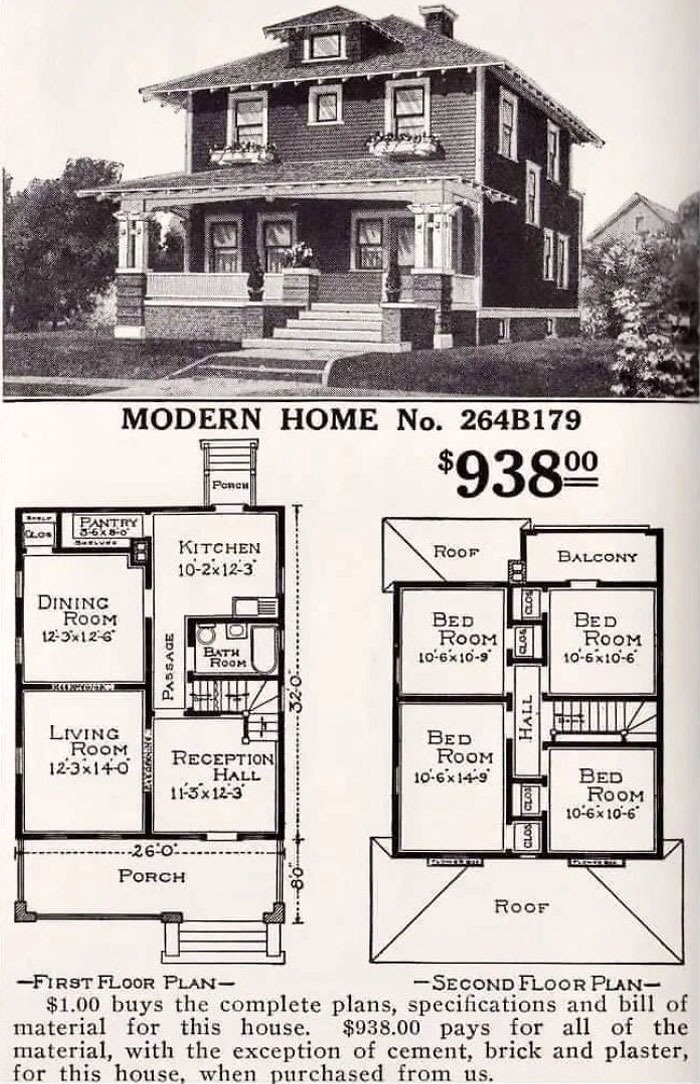

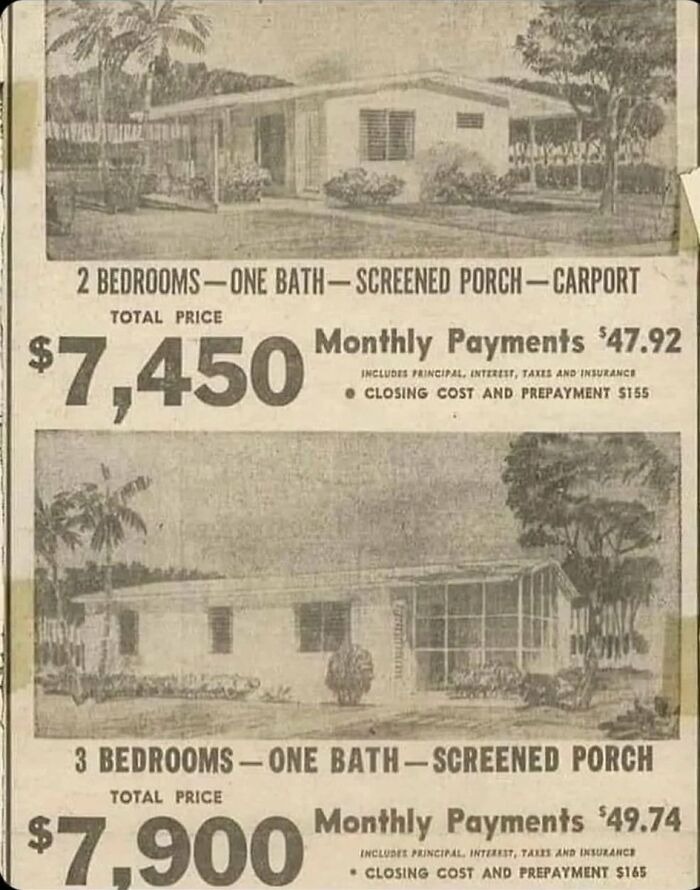

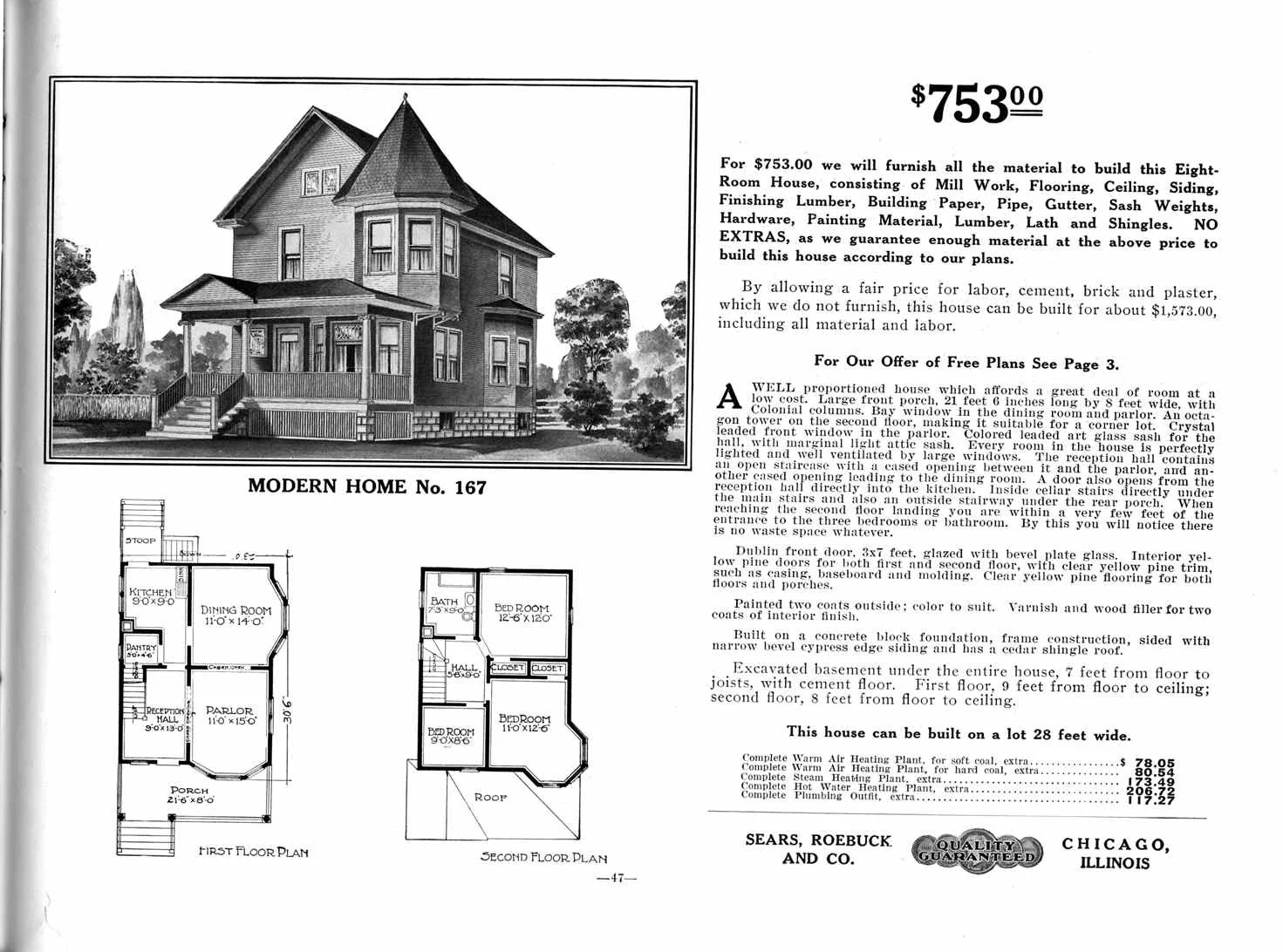

Housing is one of the most dramatic examples of rising prices. In the 1950s and 60s, homes could be purchased for under $20,000.

In fact, advertisements from the 1960s showed stylish, modern homes for less than $17,000. Mortgages were also significantly more affordable, with monthly payments often under $50.

The post-war housing boom saw many families able to buy their first homes and furnish them with budgets under $1,000.

Contrast this with today’s housing market, where the average home price in many areas exceeds $300,000, and mortgage payments are often more than $1,500 per month.

Then: Full homes for under $17,000.

Now: Average home prices in the hundreds of thousands.

Gas Prices: A Penny Pincher’s Dream

It wasn’t so long ago that gas was considered a small expense. In the 1960s, a gallon of gas was priced at just 22 cents.

Driving cross-country was affordable, and filling up your tank didn’t break the bank.

Today, with gas prices fluctuating between $3 and $5 a gallon, it’s a far cry from the days when a road trip seemed like a bargain.

Then: Gas for 22 cents per gallon.

Now: Gas prices commonly range between $3 to $5 per gallon.

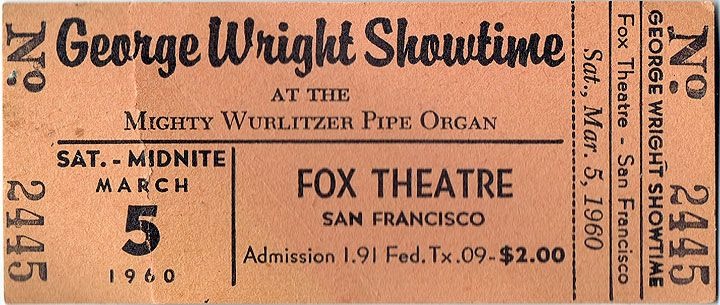

Entertainment: Concerts and Movies for a Few Bucks

Entertainment was another area where the cost was once minimal. Concert tickets in the 1970s were astonishingly cheap compared to today’s standards.

For example, a Led Zeppelin concert ticket in 1973 cost just $5. Imagine seeing one of the biggest rock bands in history for the price of a coffee today!

Even movie tickets and entertainment venues were affordable, with tickets to the orchestra in 1960 costing around $2.

Then: $5 for a Led Zeppelin concert in 1973.

Now: Concert tickets can easily exceed $100, especially for major artists.

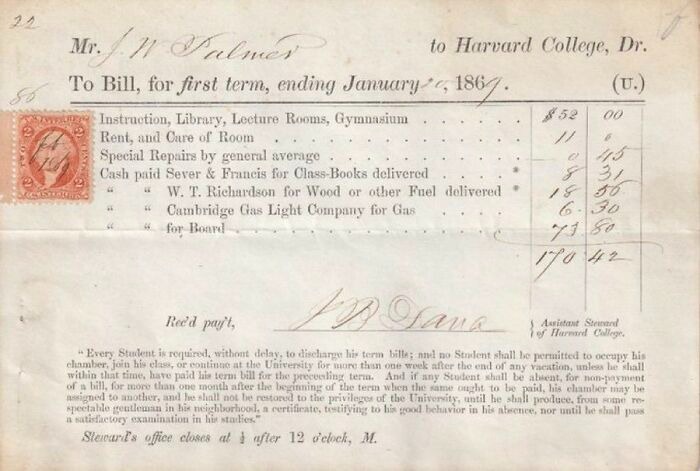

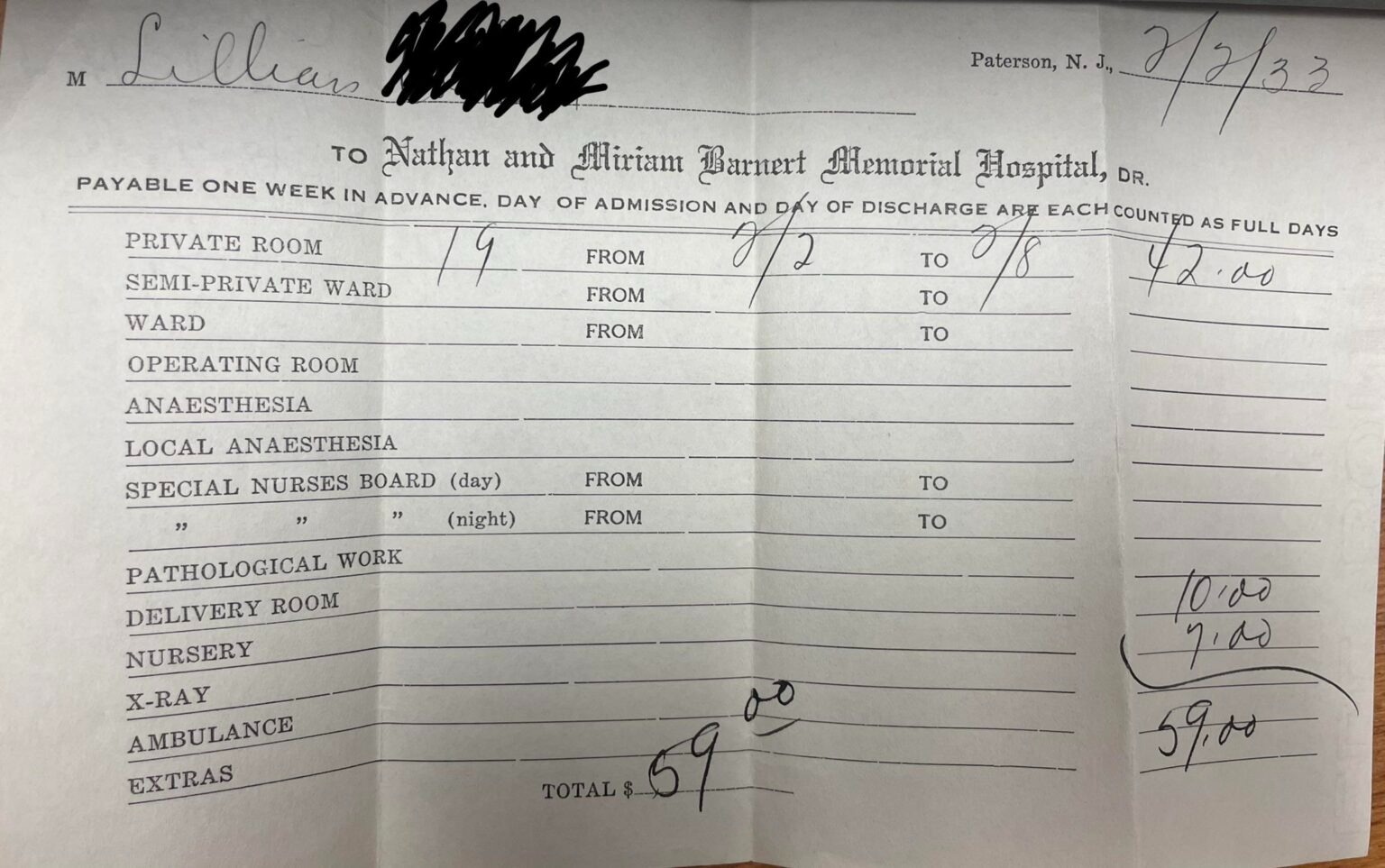

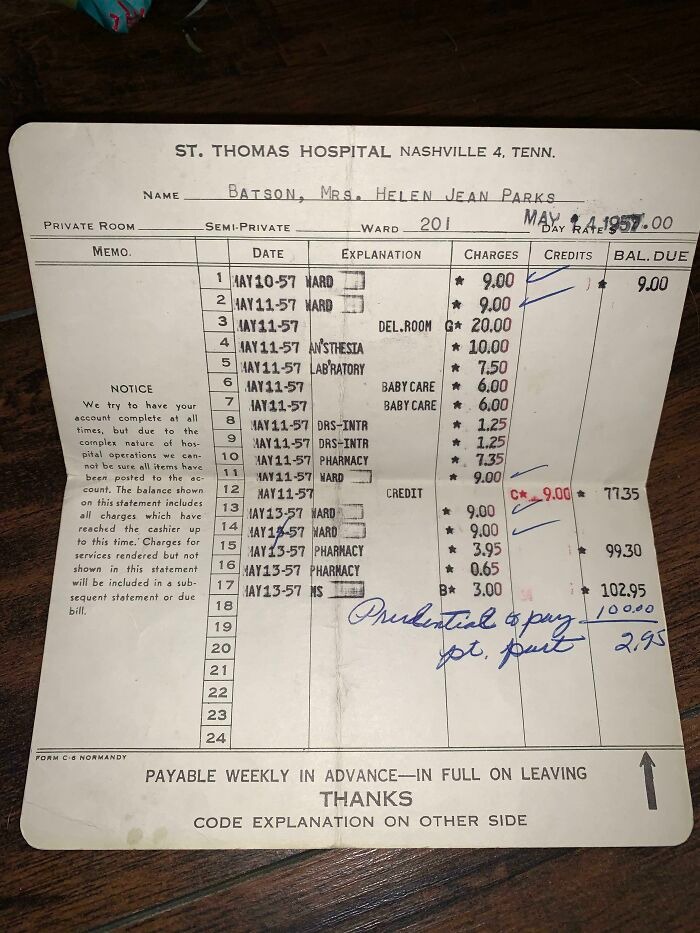

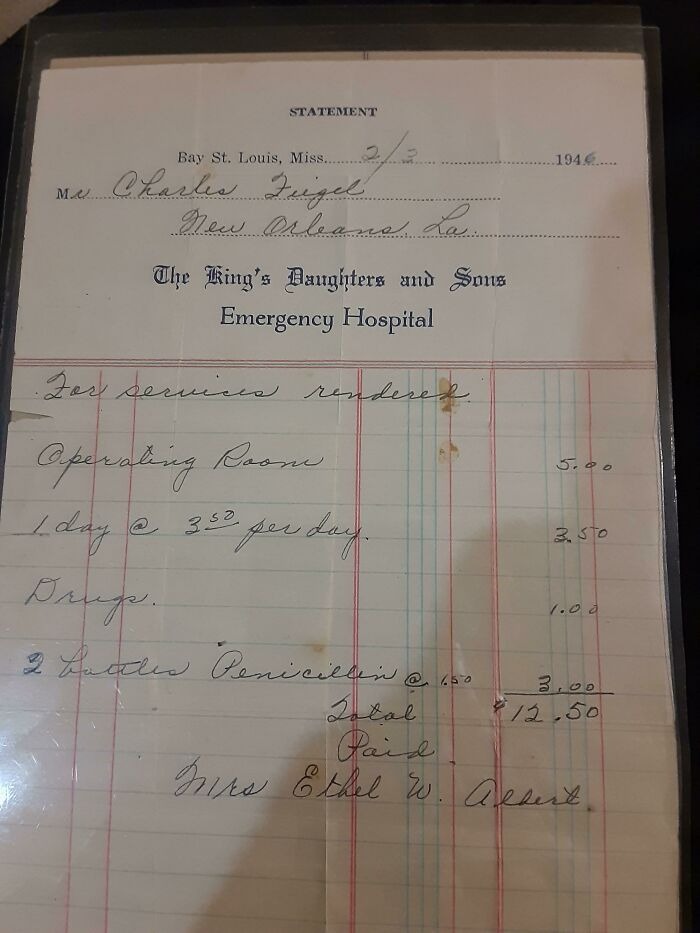

Education and Healthcare: Then vs. Now

Not only have the prices of everyday goods gone up, but so have the costs of education and healthcare.

Harvard University tuition in 1869 was just $170 for one semester. In stark contrast, today’s tuition at Harvard exceeds $50,000 per year.

Healthcare is another area that’s seen tremendous inflation. A hospital bill from 1933 shows a discharge fee of just $59, while the cost of delivering a baby in 1957 was a mere fraction of what it is today.

Then: $59 hospital discharge in 1933.

Now: Medical bills can run into the thousands, even for routine care.

The contrast between prices then and now is a clear reflection of inflation’s impact over the years.

Although wages have increased, the rise in the cost of living has outpaced income growth, making it harder for families to enjoy the same level of comfort that previous generations experienced.